A cost center is a crucial concept in managerial accounting and financial management. It refers to a department or function within an organization that incurs expenses but does not directly generate revenue. Understanding cost centers is essential for effective financial planning and control in any business, as they play a significant role in the organization’s overall financial health.

Understanding the Basics of a Cost Center

Before diving deeper, it's important to understand the foundational aspects of what a cost center is. Generally, cost centers are responsible for managing expenses and resources rather than generating income directly.

This distinction allows organizations to track costs more efficiently and allocate them appropriately to various functions, ensuring that businesses remain profitable while maintaining operational effectiveness. By having a clear view of where expenditures are occurring, companies can make informed decisions that enhance their overall financial health.

Definition and Purpose of a Cost Center

A cost center can be defined as a unit within an organization that does not generate revenue directly but is significant in the overall functioning of the business. The primary purpose of a cost center is to manage costs associated with a specific function, department, or project.

By separating these costs, organizations can gain detailed insights into where their money is going and identify areas for potential improvement or cost-saving measures. This strategic approach not only helps in budgeting but also in forecasting future expenses, allowing businesses to plan more effectively for growth and operational changes.

Key Characteristics of a Cost Center

Cost centers typically have a few distinguishing characteristics that set them apart. These include:

- No Revenue Generation: Cost centers do not directly contribute to generating sales or revenue.

- Budget Focused: They operate within a specific budget that management allocates.

- Performance Measurement: Success is measured mainly through budget adherence and efficiency in resource utilization rather than profit.

Understanding these characteristics helps organizations to manage their cost centers effectively and align their strategic goals with operational efficiency. Moreover, cost centers can serve as a valuable tool for accountability within departments, as managers are often held responsible for their respective budgets and are encouraged to find innovative ways to reduce costs without compromising quality.

Additionally, the implementation of cost centers can lead to enhanced communication and collaboration across departments. When teams are aware of the financial implications of their activities, they are more likely to work together to optimize resources and share best practices. This collaborative spirit can foster a culture of continuous improvement, where every employee feels empowered to contribute to the organization's financial health.

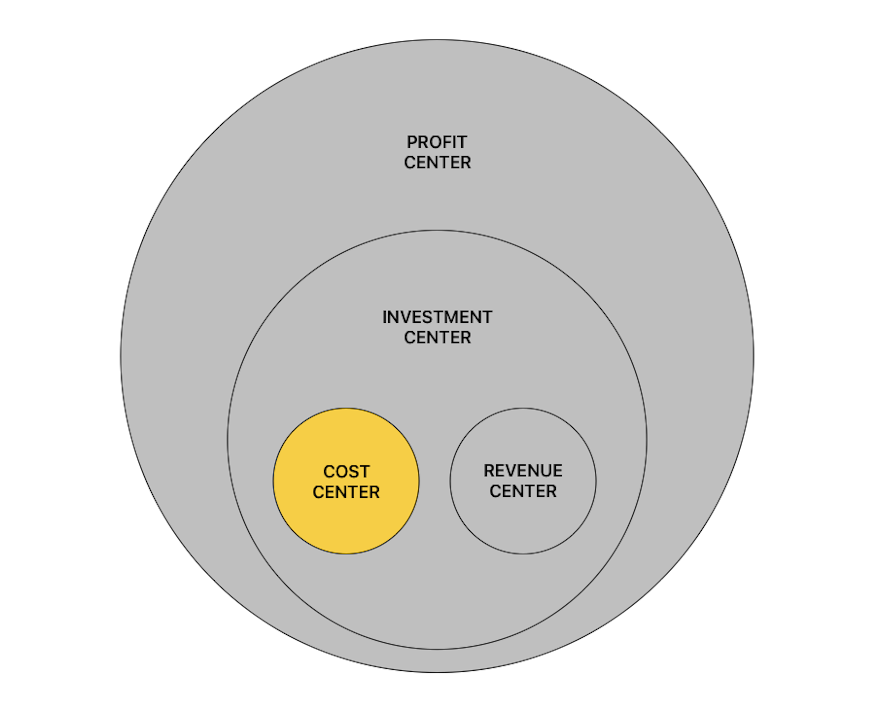

Differentiating Between Cost Centers and Profit Centers

Understanding the differences between cost centers and profit centers is vital for effective business management. This differentiation helps companies establish clear roles and responsibilities across various departments. By doing so, organizations can ensure that each unit is aligned with the overall strategic goals, thus enhancing operational efficiency and financial performance.

Both cost centers and profit centers come with distinct roles and responsibilities that reflect their objectives. Understanding these roles is crucial for effective management and performance evaluation.

- Cost Centers: Responsible for tracking expenses, adhering to budgets, and enhancing operational efficiency. They often employ various cost-control measures and performance metrics to ensure they operate within financial constraints.

- Profit Centers: Focus on revenue generation, managing both costs and sales performance. They are typically evaluated based on their ability to meet sales targets, profitability margins, and return on investment.

More about the difference between Cost Center and Profit Center.

The Importance of Cost Centers in Business

Cost centers play an integral role in the larger framework of business operations. They not only help manage expenses but also support long-term planning and strategic objectives.

Financial Management and Cost Centers

Effective financial management relies on a comprehensive understanding of cost centers. By isolating costs in these areas, organizations can analyze their financial performance more granularly.

This visibility enables businesses to make informed decisions about resource allocation, identify trends, and uncover potential inefficiencies.

Moreover, managing cost centers effectively can lead to improved budgeting processes and cost control measures, which are essential in maintaining a healthy bottom line.

Furthermore, the ability to track and evaluate the performance of various cost centers can foster a culture of accountability within the organization. When departments are aware that their expenditures are being monitored, they are more likely to adopt cost-effective practices and strive for operational excellence. This not only enhances the overall efficiency of the company but also encourages innovation as teams explore new ways to reduce costs while maintaining quality.

Strategic Planning and Cost Centers

Cost centers also contribute significantly to strategic planning efforts. By understanding the cost structures within these centers, businesses can align their strategic goals with operational capabilities.

Additionally, insights gained from analyzing cost center performance can inform decisions about future investments, employee training, and process improvements. This strategic alignment ensures that all parts of the organization work towards common objectives, ultimately enhancing competitiveness.

Moreover, the integration of cost center analysis into strategic planning can lead to a more agile business model. As market conditions change, organizations that have a clear understanding of their cost centers can pivot more quickly, reallocating resources to areas that promise higher returns or require immediate attention. This adaptability not only safeguards the company’s current market position but also opens up avenues for growth in emerging sectors, ensuring that the business remains relevant and proactive in a dynamic economic landscape.

Examples of Cost Centers

In technology companies, cost centers refer to departments or units that do not directly contribute to profit but incur costs as they support the company’s operations. These cost centers are crucial for the smooth running and growth of the organization, even though they don’t generate revenue directly. Here are some common examples of cost centers in technology companies:

IT Department

- Functions: Managing and maintaining internal technology infrastructure, hardware, software, network security, and technical support.

- Costs: Hardware purchases, software licensing, IT support salaries, data center expenses.

Research and Development (R&D)

- Functions: Innovating, developing new products, enhancing existing technologies, and conducting experiments to explore new solutions.

- Costs: Salaries of engineers and researchers, lab equipment, development tools, and prototype expenses.

Human Resources (HR)

- Functions: Recruitment, onboarding, employee training and development, benefits administration, and managing workplace culture.

- Costs: Salaries of HR staff, recruitment expenses, training programs, employee wellness initiatives.

Administrative/Operations Department

- Functions: Managing day-to-day operations, office management, executive support, and general business administration.

- Costs: Office supplies, salaries of administrative staff, facilities management, utilities.

Customer Support/Service

- Functions: Providing assistance to users or clients with technical issues, onboarding, and product usage support.

- Costs: Salaries of support staff, software for help desk operations, training, and related resources.

Finance and Accounting

- Functions: Managing budgets, financial planning, auditing, payroll, accounts payable and receivable, and financial reporting.

- Costs: Salaries of finance professionals, accounting software, audit fees, and compliance expenses.

Legal and Compliance

- Functions: Ensuring the company complies with laws, managing contracts, handling intellectual property, and addressing any legal disputes.

- Costs: Salaries for legal staff, external legal services, compliance software, and regulatory fees.

Marketing Department

- Functions: Promoting the company’s brand, managing advertising campaigns, conducting market research, and creating content.

- Costs: Advertising expenses, salaries for marketing professionals, digital marketing tools, and promotional events.

Facilities Management

- Functions: Overseeing physical locations and ensuring that facilities are safe, efficient, and compliant.

- Costs: Rent, building maintenance, cleaning services, security, and utilities.

Training and Development

- Functions: Providing ongoing learning opportunities, certifications, and skills development for employees.

- Costs: Salaries of training staff, courses, learning management systems, and training materials.

Security (Physical and Cybersecurity)

- Functions: Protecting the company’s physical and digital assets from threats, ensuring data security and employee safety.

- Costs: Salaries for security professionals, surveillance systems, cybersecurity software, and training programs.

Project Management Office (PMO)

- Functions: Managing project portfolios, standardizing project management processes, and ensuring projects are completed on time and within budget.

- Costs: Salaries for project managers, project management tools, and operational expenses related to project tracking.

Quality Assurance (QA)

- Functions: Ensuring that products meet specific standards of quality through testing and review processes.

- Costs: Salaries of QA engineers, testing software, and quality control tools.

Data and Analytics

- Functions: Collecting, managing, and analyzing data to support business decision-making.

- Costs: Salaries for data analysts and data scientists, data storage solutions, analytics platforms.

Corporate Communications/Public Relations (PR)

- Functions: Managing the company's internal and external communications, public relations strategies, and crisis management.

- Costs: Salaries for communication professionals, press releases, PR agencies, and media monitoring tools.

How to Manage a Cost Center Effectively

Managing a cost center requires strategic thinking and meticulous attention to detail. Certain practices can significantly enhance the efficiency and effectiveness of these units.

Budgeting for a Cost Center

Budgeting is one of the most critical aspects of managing a cost center. Establishing a clear budget helps ensure that costs remain controllable and within acceptable limits.

Companies should regularly review budget performance against actual expenses, allowing them to adjust forecasts and spending as necessary. Involving team members in the budgeting process can foster a sense of ownership and accountability.

Performance Evaluation in Cost Centers

Regular performance evaluations are essential for effective cost center management. Establishing key performance indicators (KPIs) allows organizations to assess the efficiency and effectiveness of each cost center.

Analyzing performance data can lead to actionable insights, highlighting areas where resources can be optimized or costs reduced. Regular reviews also facilitate continuous improvement efforts, contributing to the overall success of the organization.

In conclusion, understanding cost centers is fundamental to effective business management. By recognizing their role, differentiating them from profit centers, and implementing best practices for management, organizations can optimize their financial performance and strategic planning processes.