Understanding the Concept of a Profit Center

A profit center is a distinct segment within a company that is responsible for generating revenue. Unlike cost centers, which focus solely on costs incurred without a direct link to revenue generation, profit centers are evaluated based on their profitability. By analyzing the financial performance of these segments, businesses can make informed decisions about resource allocation, performance evaluation, and strategic planning.

The concept of profit centers facilitates a more granular approach to financial management. It allows managers to track the performance of different divisions or products, aiding in identifying areas that require improvement and those that are performing well. This focused approach encourages accountability and motivates teams to optimize revenues.

Definition and Basic Explanation

A profit center is defined as a unit within an organization that is treated as a separate entity for financial accountability. It is typically responsible for producing revenue through its operations, and its performance is measured based on its ability to contribute to the company's overall profitability. Profit centers can vary in size and scope, ranging from entire departments to specific products or services.

Organizations often establish profit centers to evaluate the profitability of distinct segments, making it easier to identify successful strategies and areas needing enhancement. The identification of a profit center can significantly influence budgeting, forecasting, and strategic decision-making processes. For instance, a company may choose to designate a new product line as a profit center to closely monitor its financial health and market performance, allowing for timely adjustments in strategy based on real-time data.

Importance of a Profit Center in Business

Profit centers are crucial for fostering a profitability-driven culture within a company. By decentralizing financial responsibility and enabling managers to operate profit centers independently, organizations promote a sense of ownership and accountability. This structure can lead to improved performance outcomes, as managers are keenly aware that their decisions directly impact their segment's financial results.

Furthermore, the establishment of profit centers aids in better resource allocation. Organizations can prioritize investments in high-performing areas while scrutinizing segments that underperform, allowing for more strategic use of capital. Understanding the profitability of different segments enables better decision-making regarding pricing, product development, and market expansion. For example, if a particular division consistently exceeds profitability targets, it may warrant increased investment to further enhance its capabilities or expand its market reach. Conversely, a struggling segment may require a reevaluation of its business model or operational strategies to align it more closely with the company's overall goals.

Additionally, profit centers can enhance competitive advantage by fostering innovation. When managers are empowered to make decisions that directly affect their profit centers, they are more likely to experiment with new ideas, products, or services that could drive revenue growth. This entrepreneurial spirit can lead to the development of unique offerings that differentiate the company in the marketplace, ultimately contributing to long-term success. By understanding the dynamics of their profit centers, businesses can also better anticipate market trends and customer preferences, allowing them to adapt swiftly to changing conditions.

Differentiating Between Profit Center and Cost Center

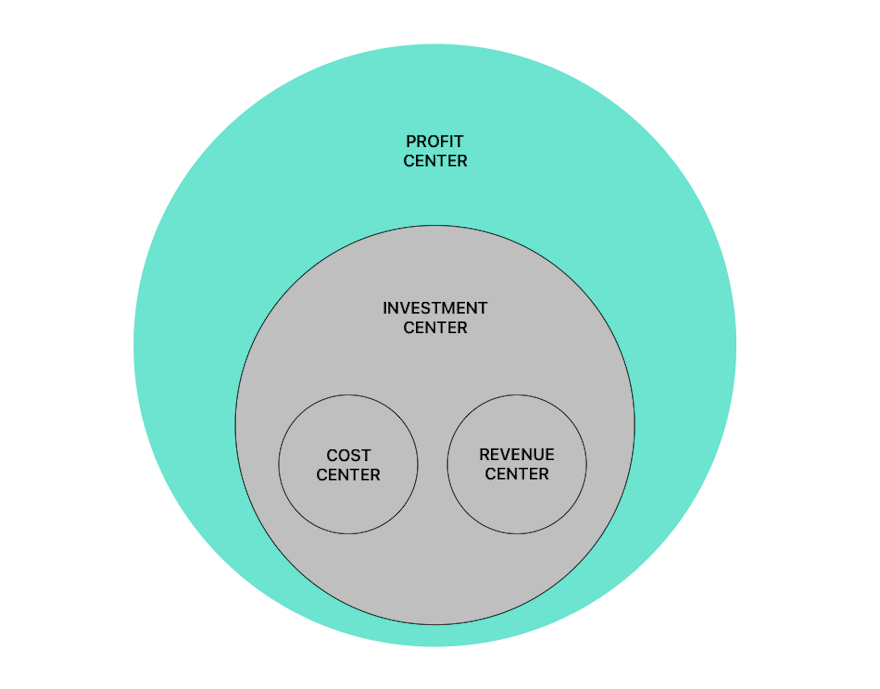

It is essential to distinguish between profit centers and cost centers as both play different roles in an organization. A cost center is a department or unit that incurs expenses but does not directly generate revenue. Unlike profit centers that are evaluated based on profits, cost centers are typically assessed based on their efficiency in managing expenses.

This differentiation is critical for management accounting, budgeting, and performance evaluations. While profit centers aim to maximize revenues and minimize costs to boost profitability, cost centers focus solely on minimizing costs and optimizing operations without the pressure of generating income. Understanding these distinctions helps organizations allocate resources more effectively and align their strategic goals with operational realities.

Key Characteristics of Profit Centers

Profit centers exhibit several characteristics that differentiate them from other units within an organization. First and foremost, they are revenue-generating units. Additionally, profit centers have defined budgets that allow them to operate autonomously, making financial decisions without needing approval from higher management.

They are accountable for both revenues and expenses, ensuring that profit center managers maintain profitability through effective cost management. This accountability instills a strong sense of financial stewardship, often leading to better decision-making and strategic initiatives within these units. Furthermore, profit centers often foster a competitive spirit among teams, as they strive to outperform their targets and contribute to the overall financial health of the organization. This dynamic can lead to innovation and improved customer service, as profit centers are motivated to meet and exceed market demands.

Key Characteristics of Cost Centers

Cost centers, in contrast, are defined primarily by their function of controlling and reducing expenses. They do not directly contribute to revenue, but their efficient operation is vital for overall business performance. Cost centers track expenses and budget compliance, focusing on operational efficiency.

Examples of cost centers include human resources, accounting, and management services. These units help ensure that resources are utilized effectively, contributing indirectly to the organization's profitability by supporting revenue-generating units. Moreover, cost centers often play a crucial role in strategic planning by providing insights into cost structures and potential areas for improvement. By analyzing their operational processes, cost centers can identify inefficiencies and suggest changes that may lead to significant savings, ultimately benefiting the entire organization. This proactive approach to cost management is essential in today’s competitive landscape, where every dollar saved can enhance the bottom line.

The Role of a Profit Center Manager

The role of a profit center manager is multifaceted, requiring a blend of financial acumen, strategic insight, and operational expertise. They are tasked with overseeing the day-to-day operations of their respective segments, ensuring that all functions align with the overarching business strategy and contribute to profitability. This involves not only managing the financial aspects but also fostering a culture of accountability and performance within their teams, which can significantly impact overall business success.

Profit center managers are expected to make informed decisions, relying on financial reports and market analyses to guide their actions. They must strike a balance between driving sales and managing expenses, effectively optimizing their unit’s performance while maintaining financial sustainability. In doing so, they often need to develop innovative solutions to challenges that arise, whether it's adapting to changing market conditions or responding to shifts in consumer behavior, ensuring that their profit center remains competitive and resilient.

Responsibilities and Duties

Profit center managers have a range of responsibilities, including setting financial targets, preparing budgets, and conducting performance evaluations. They are charged with identifying opportunities for revenue growth and implementing strategies to enhance profitability, such as cost-cutting measures and productivity improvements. This proactive approach often involves collaborating with other departments, such as marketing and sales, to align initiatives that drive customer engagement and boost sales figures.

Additionally, they must regularly report their performance to senior management, providing insights into market trends, competitive analysis, and potential risks. This transparency ensures that profit center strategies align with the company's overall objectives, facilitating informed decision-making at all levels of the organization. Furthermore, profit center managers often play a crucial role in mentoring their teams, equipping them with the skills and knowledge necessary to excel in their roles, which ultimately contributes to a more cohesive and effective work environment.

Required Skills and Qualifications

To be effective in their roles, profit center managers must possess a diverse skill set that includes strong analytical abilities, financial management knowledge, and leadership skills. They should be proficient in budgeting and forecasting, along with having experience in market research and competitive analysis. A deep understanding of financial metrics and key performance indicators (KPIs) is vital, as these tools help managers assess their unit's performance and make data-driven decisions that can lead to improved outcomes.

Additionally, effective communication skills are essential, as profit center managers must interact with various stakeholders, including team members, upper management, and clients. They often serve as the bridge between different levels of the organization, ensuring that everyone is aligned with the profit center's goals. A solid understanding of the industry's dynamics and trends is also crucial for making strategic decisions that enhance profitability. This knowledge not only aids in anticipating market shifts but also empowers managers to innovate and adapt their strategies, keeping their profit centers agile and responsive to external challenges.

Measuring the Performance of a Profit Center

Measuring the performance of a profit center involves analyzing various financial metrics and evaluating the unit's contributions to the organization's overall profitability. Establishing Key Performance Indicators (KPIs) is essential for tracking success and identifying areas for improvement.

These metrics provide valuable insights into sales volumes, revenue growth, profit margins, and cost management, enabling managers to make data-driven decisions that optimize performance. Regular performance reviews can help align goals and ensure accountability across the profit center.

Key Performance Indicators (KPIs)

Some of the KPIs commonly used to measure the performance of a profit center include:

- Gross Profit Margin: This measures the percentage of revenue remaining after deducting the cost of goods sold, indicating the efficiency of production and pricing strategies.

- Net Profit Margin: It reflects the overall profitability of the profit center, calculated by dividing net income by total revenue.

- Return on Investment (ROI): This indicates how effectively the profit center generates returns relative to its invested capital.

- Revenue Growth Rate: It quantifies the increase in sales over a specified period, providing insight into market demand and overall competitiveness.

These KPIs help managers monitor performance trends, assess strategic decisions, and adapt to market changes swiftly.

Profit Center Analysis and Reporting

Profit center analysis involves a comprehensive review of the financial performance and operational efficacy of the unit. Regular analysis helps to understand variances between expected and actual performance, enabling managers to respond proactively to any underperformance or deviations from strategic plans.

Reporting also plays a significant role in profit center analysis. Detailed reports should provide insights not only on financial performance but also on operational issues, customer satisfaction, and market positioning. This holistic approach ensures that profit center managers are equipped with the information they need to make informed decisions.

Advantages and Disadvantages of Profit Centers

Like any organizational structure, profit centers come with their set of advantages and disadvantages. Understanding these pros and cons can help organizations determine how best to implement and manage profit centers effectively.

Benefits of Implementing Profit Centers

One of the primary benefits of profit centers is improved accountability. By establishing clear responsibility for profitability, profit center managers are motivated to optimize operations and drive revenue growth. This accountability often leads to enhanced performance and increased competitiveness in the market.

Another advantage is the ability to identify and allocate resources effectively. By analyzing the performance of different profit centers, organizations can prioritize investments in areas with the highest potential returns. This data-driven approach ensures that resources are aligned with strategic goals, maximizing operational efficiency.

Potential Drawbacks and Risks

Despite their advantages, profit centers also present certain risks and drawbacks. One potential concern is that profit center managers may prioritize short-term profitability over long-term strategic objectives, leading to decisions that could adversely impact future business potential.

Additionally, the establishment of profit centers may create internal competition among units. While healthy competition can drive performance, it can also result in conflicts, misalignment, and a lack of collaboration, ultimately undermining the organization's cohesion.

In conclusion, profit centers are valuable segments within an organization that focus on profitability and financial performance. Understanding their role, distinguishing them from cost centers, and recognizing the responsibilities of profit center managers is vital for maximizing their effectiveness. By measuring performance through KPIs and analyzing results, businesses can leverage the advantages of profit centers while mitigating risks, ultimately enhancing overall profitability and competitiveness.

Read more