Investment centers play a pivotal role in the financial landscape of organizations, especially those with diversified operations. Understanding what constitutes an investment center is essential for businesses aiming to enhance their financial management and strategy. In this article, we will delve into the fundamentals of investment centers, explore how they differ from other types of centers, and discuss best practices for managing them effectively.

Understanding the Basics of an Investment Center

Definition and Purpose of an Investment Center

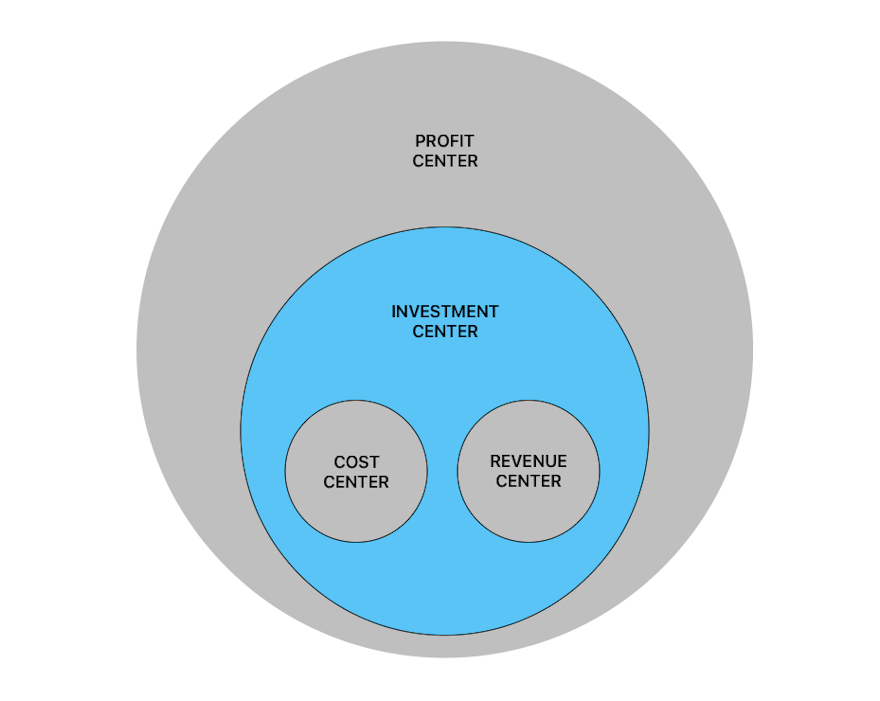

An investment center is a specific segment within an organization that is responsible not only for generating profits but also for making significant investment decisions. Unlike cost centers, which only manage expenses, or profit centers, which only focus on revenue, investment centers hold a unique position. Their primary purpose is to maximize returns on investments while managing operational effectiveness and overall costs.

The investment center is typically evaluated based on the return on investment (ROI) it generates, which highlights the importance of both profitability and capital utilization. This distinct focus allows organizations to assess the performance of various divisions or product lines with greater reliability, ensuring alignment with the overall business goals. Moreover, investment centers often have the autonomy to make decisions that can lead to innovative projects or initiatives, fostering a culture of entrepreneurship within the organization. This empowerment can lead to increased motivation among managers and employees alike, as they see the direct impact of their decisions on the organization’s success.

Key Components of an Investment Center

Investment centers exhibit several key components that differentiate them from other divisions. These include:

- Revenue Generation: Investment centers manage revenue streams, often engaging in diverse products or services to ensure financial viability.

- Expense Control: Managers of investment centers are responsible for controlling costs, ensuring that expenditure does not exceed revenue generated.

- Capital Allocation: They play an essential role in investment decisions, determining where funds will be allocated to maximize returns.

- Performance Measurement: Investment centers utilize various metrics, such as ROI and residual income, to measure success and efficiency.

These components collectively enable investment centers to drive organizational growth through informed decision-making and strategic investing. Additionally, investment centers often require a robust analytical framework to assess potential investments accurately. This may involve conducting market research, performing risk assessments, and forecasting future cash flows to ensure that capital is allocated to the most promising opportunities. By leveraging data-driven insights, investment centers can enhance their strategic positioning and respond effectively to market dynamics, thereby reinforcing their critical role within the broader organizational structure.

Differentiating Between Cost, Profit, and Investment Centers

Characteristics of Cost Centers

Cost centers are organizational units that focus solely on managing expenses. They do not directly generate revenue; instead, their performance is evaluated based on how efficiently they manage their dissipation of resources. Examples include maintenance departments and administration.

The primary goal of a cost center is to control and reduce costs while maintaining the quality of goods or services. Managers are typically assessed on their ability to meet budgetary constraints while delivering on operational capabilities. This often involves implementing cost-saving initiatives, such as optimizing workflows or negotiating better rates with suppliers. Moreover, cost centers play a crucial role in supporting the overall business by ensuring that the necessary infrastructure and services are in place, which allows revenue-generating units to operate effectively.

Characteristics of Profit Centers

Profit centers are responsible for generating revenue and controlling costs, making them a hybrid between cost centers and investment centers. Their managers are evaluated based on profitability metrics, such as gross and net profit margins.

In contrast to cost centers, profit centers have more freedom to make decisions that affect both income and expenses. While they do manage profits, they typically do not have the authority to make significant capital investments. Instead, any capital-related decisions must be approved by upper management. This structure encourages profit center managers to be innovative and proactive in their strategies, often leading to the development of new products or services that can enhance revenue streams. Additionally, profit centers are often tasked with analyzing market trends and customer feedback, allowing them to adapt their offerings to meet changing demands more swiftly than their cost center counterparts.

The Role of an Investment Center in a Business

How Investment Centers Contribute to Financial Growth

Investment centers are integral to a business's financial growth strategy as they directly influence capital investments and operational efficiency. By strategically allocating resources, these centers are positioned to identify lucrative opportunities that can lead to significant returns.

Furthermore, they can respond to market changes and investment trends more flexibly than other organizational units, allowing them to harness growth opportunities quickly. This agility in decision-making is crucial for maintaining a competitive edge in the marketplace. For instance, during economic downturns, investment centers can pivot their strategies to focus on cost-effective investments or explore alternative markets, ensuring that the business remains resilient and adaptable. This proactive approach not only mitigates risks but also positions the company to capitalize on emerging trends as the market recovers.

Investment centers often utilize advanced data analytics and market research to forecast potential investment outcomes, enabling them to make informed decisions that align with the company's long-term vision. By leveraging technology and analytical tools, they can assess the viability of projects with greater accuracy, thus optimizing the allocation of capital and enhancing overall financial performance.

The Relationship Between Investment Centers and Business Strategy

Investment centers align closely with the overarching business strategy. Their ability to analyze performance through financial metrics allows them to inform strategic decisions that can lead to improved market positioning.

As these centers often oversee significant portions of a company's investments, their performance impacts total organizational outcomes. Thus, effective management of investment centers directly underscores the importance of strategic planning and execution within the larger context of business operations. This relationship is further strengthened by regular communication between investment center managers and executive leadership, ensuring that investment strategies are not only aligned with current business objectives but also adaptable to future shifts in the market landscape.

Additionally, investment centers play a pivotal role in fostering innovation within the organization. By encouraging a culture of experimentation and calculated risk-taking, they can spearhead initiatives that drive product development and market expansion. This proactive stance not only enhances the company's portfolio but also cultivates an environment where creative solutions can flourish, ultimately leading to sustainable growth and a robust competitive advantage in the industry.

Evaluating the Performance of an Investment Center

Key Performance Indicators for Investment Centers

Key performance indicators (KPIs) are essential in gauging the success of investment centers. Common KPIs include:

- Return on Investment (ROI): Measures the efficiency of capital utilization.

- Residual Income: Assesses the net income remaining after deducting capital charge.

- Economic Value Added (EVA): Represents the company’s financial performance based on the idea of shareholder value maximization.

Using these indicators, organizations can effectively evaluate how well their investment centers are performing with respect to financial targets and strategic goals. Furthermore, the integration of these KPIs into regular reporting can foster a culture of accountability and continuous improvement, encouraging managers to make informed decisions that align with the overall business strategy. By regularly reviewing these metrics, companies can identify trends, set benchmarks, and implement corrective actions when necessary, ultimately driving better performance across all investment centers.

Challenges in Measuring Investment Center Performance

Despite the availability of KPIs, measuring the performance of investment centers presents challenges. There can be difficulties in accurately attributing revenues and costs to specific investment centers due to shared resources and inter-departmental dependencies. For instance, when multiple investment centers utilize the same marketing or administrative resources, it becomes increasingly complex to determine which center should bear the associated costs, leading to potential distortions in performance evaluation.

Additionally, market fluctuations and external economic factors can significantly impact investment outcomes, complicating assessments of performance. For example, a sudden economic downturn or changes in consumer preferences can adversely affect the profitability of an investment center, making it appear less effective than it may actually be under normal conditions. Thus, organizations need to adopt multifaceted evaluation approaches that consider both quantitative metrics and qualitative factors. This might include conducting regular SWOT analyses to identify strengths, weaknesses, opportunities, and threats, as well as gathering feedback from stakeholders to gain insights into operational efficiencies and market positioning. By embracing a holistic view of performance measurement, companies can better navigate the complexities inherent in evaluating investment centers and make more strategic decisions moving forward.

Best Practices for Managing an Investment Center

Effective Strategies for Investment Center Management

To optimize the performance of investment centers, businesses should implement effective management strategies. These include:

- Regular Performance Reviews: Conduct periodic evaluations to analyze performance against benchmarks.

- Empowering Managers: Equip managers with the authority to make decisions that impact profitability and investments.

- Continuous Forecasting: Use real-time data analysis and forecasting to adjust strategies in response to market conditions.

By employing these strategies, organizations can enhance operational efficiencies and drive better investment decisions. Furthermore, fostering a culture of transparency within the investment center can significantly improve communication and collaboration among team members. Regularly sharing performance metrics and insights not only motivates employees but also encourages them to take ownership of their roles, leading to innovative solutions and improved outcomes.

Additionally, investing in training and development programs for managers can equip them with the latest financial tools and analytical techniques. This ongoing education ensures that they remain agile and responsive to the ever-evolving market landscape, ultimately benefiting the organization as a whole.

Common Mistakes to Avoid in Investment Center Management

While managing investment centers, organizations should be mindful of common pitfalls. These include:

- Overemphasis on Short-term Gains: Focusing solely on immediate profits can lead to neglecting long-term growth opportunities.

- Lack of Alignment with Business Strategy: Management decisions must align with the overall business goals to ensure coherence and effectiveness.

- Ignoring Market Dynamics: Failure to adapt to market changes can result in outdated strategies that fail to deliver results.

Avoiding these mistakes allows investment centers to function optimally within the broader context of the organization. Moreover, organizations should be cautious of creating silos within their investment centers, as this can hinder collaboration and the sharing of critical information. Encouraging cross-departmental initiatives can lead to a more integrated approach, where insights from various functions contribute to more informed investment decisions.

Another common oversight is the failure to leverage technology effectively. By utilizing advanced analytics and investment management software, businesses can gain deeper insights into performance metrics and market trends. This technological integration not only streamlines operations but also enhances the accuracy of forecasting, allowing investment centers to make data-driven decisions that align with both short-term objectives and long-term strategic goals.